Simple RV Finance Calculator

Quickly Generate Your Own Estimates, Consider Loan Options with Easy’s RV Calculator. Estimate Your RV Loan Options Now!

Easily Compare Caravan Loan Interest Rates & Repayments with Our RV Calculator

Securing the best interest rate is crucial to securing the best caravan loan. Rates vary across the leisure lending market and comparing percentages can provide less than ideal information on loan repayments. Our calculating device allows buyers to instantly change interest rates to monthly repayment estimates – a figure generally more relevant to individual budgets.

Rates for all types of loans for caravans can be used in the device – Secured Caravan Loan and Unsecured Personal Loan for private buyers, and Lease, CHP, Rent-to-Own, and Chattel Mortgage for business buyers. While lenders assess applications individually when preparing rate offers, use our current rates as a guide when calculating estimates. Do rate comparisons in seconds!

Easy Caravan Finance sources the most competitive loan rates from across a vast 80+ lender base. Individually matching loan applicant specifics with lender criteria to ensure the best rates from the right lender are achieved. Compare how competitive Easy is in the market by calculating estimates with other lender rates and see the difference. For your individually sourced caravan loan interest rate, connect with Easy for a quick quote.

- Compare lender interest rates for Secured Caravan Finance and Unsecured Personal Loans.

- Calculate repayments for business finance products.

- Quickly convert an interest rate to a monthly repayment.

Read more...

We’ve made it easy for recreational vehicle buyers requiring finance, to quickly obtain their own estimates to consider their loan options. Our calculating device is simple to use, accessible Australia-wide and can be used for loans on all types of caravans, campers, campervans and other RVs.

Empowering buyers to compare caravan loan interest rates, calculate repayment estimates, evaluate makes and models, work out their preferred terms, set personal budgets, decide on down payments, and generally be better informed and well-prepared to source affordable financing. With versatility, functionality, and flexibility, our device can be an invaluable tool for buyers considering taking on caravan finance.

Get started by estimating repayments on the vehicles you have on your short list.

Simple RV Calculator Use Delivering Powerful RV Buyer Decision Making Support

Get assistance to decide on the vehicle with a price tag that meets your repayment budget with the calculating device. Easily convert caravan prices to estimated repayments in seconds. Enter the price as the total loan with preferred repayment term and relevant interest rate, to immediately see the per month payment estimate. Reduce the loan total/price entered to allow for your preferred deposit. Repeat for vehicles at different prices to establish the price range that will work with your budget. Ideal tool to start building a short list of vehicles before visiting showrooms for inspections.

Our calculation device has the versatility to deliver estimates for all the different types of RVs on the market. All models from both local manufacturers and imported brands. Calculate and compare hybrids, traditional vans, camper trailers, motorhomes, pop-tops, campervans, toy haulers, off-road models, across all levels of price and luxury inclusions. Explore your options to suit your travel and holiday style.

Want to own your vehicle quickly or spread the repayments over as long a time as possible? This can be a very personal decision and based on numerous factors. The term of the caravan loan in conjunction with the borrowing amount and rate, determines the monthly repayment. Buyers can easily change the term entered in the calculation device to see what the monthly loan commitment may be with various repayment schedules. Note the results to be prepared to brief your Easy broker for a quote based on your preferences.

When using a calculation device, the user is in total charge and control of the values entered. Providing flexibility to work up and assess a number of combinations of rates, total and term, and for business buyers, balloons, to find their most suitable loan option. Note the results as the device does not have a memory to store calculations.

No need to make a phone call or wait until business hours to prepare and plan your caravan finance. Our calculating device is available online 24/7 for use by buyers seeking finance. Use the device while attending caravan shows to quickly calculate repayments to take advantage of show specials. Use it while discussing your order with a dealer to decide on accessories and options. Use while travelling across Australia to plan your next vehicle purchase. Connect and start estimating!

Quickly Change Caravan Prices to Loan Repayment Estimates

Converting a price to a monthly loan payment can provide a valuable insight into the affordability of that caravan with individual budgets. It only takes a few seconds to find out the price range you should be considering, to ensure your loan payments meet your affordability expectations. Enter the vehicle price as the loan amount, our advertised rate for your credit product, your preferred repayment term, and the monthly repayment amount for that combination will be displayed. If making a downpayment, take that from the price before entering the borrowing total. Follow the same procedure for as many vehicles as you are considering, to establish your target price range. Saves time on unnecessary dealership visits.

Versatile Functionality – All Types of RVs

Loans for the full selection of different types of recreational vehicles, new and used, can be estimated with our device. This includes the traditional caravan, camper trailers, campervans, toy haulers, home-on-wheels motorhomes, off-road vehicles, expedition vehicles, hybrids, budget compact models and custom-built caravans, across all lengths, configurations and price ranges. The same loan products apply, so enter your figure and start comparing a camper with a caravan, a fully off-road with a hybrid, an entry level with a fully decked out model. With our competitive rates, you may be pleasantly surprised at how affordable your choice may be.

Decide on Your Repayment Schedule

An important aspect of a loan is the term – the number of months, years or repayments, it takes to finalise the loan. The term can come down to personal preferences, but lenders do need to approve the term. To decide if finalising the loan in a short, medium or longer term best suits your objectives, calculate repayment estimates at different terms. This is an easy calculation. Leave the total and interest rate constant while changing the term and noting the repayment. This is a great way to decide on your preferred loan structure and be ready when it comes time to apply.

Evaluate Different Loan Options

You have full control of the figures entered when using the calculating device. Giving you the opportunity to work up varying combinations of total loan and terms, to evaluate your options. This can be an extremely useful process to decide how much deposit to set aside to reduce the borrowing, and to establish your budget based on the terms and repayments. Don’t forget to note down the outcomes as the device does not store the calculations.

Access All Hours, All Locations, with Online Convenience

Get the repayment estimates you want, when you need them. When checking out the second-hand market online, when visiting a caravan show, when at a dealership in discussions about price. The calculation device can be used from any device with connectivity. Putting the power of generating quick estimates squarely and conveniently, in your hands. Don’t take the chance of missing a good caravan deal while waiting on a call back from a lender. Estimate yourself and make quick decisions.

Organise Multiple Loan Aspects with Handy RV Calculator

- Plan finance preferences prior to submitting a loan application.

- Assess affordability, select vehicles – convert prices to repayment estimates.

- Compare caravan loan interest rates to find the most competitive.

- Prepare your budget and buying timeline.

- Clarify your individual requirements. Build the confidence to proceed.

How to Use the RV Calculator with 3 Basic Steps

Using our caravan loan calculator to generate your repayment estimates involves essentially 3 basic steps – entering your choice of amounts into the spaces indicated. No expertise in finance or maths is needed, just a basic understanding of computer-based forms. You enter the details you want, and the device carries out the computations.

First Step Decide on how much you require to purchase your vehicle and type that figure into the space for loan amount. If simply looking to compare repayments for different priced vehicles, enter the total price. If making a downpayment, allow for that when entering your borrowing amount.

Second Step Enter the rate that corresponds to your chosen credit facility into the interest rate space. If you haven’t sourced rates across the market, use our current rates.

Third Step To compute the repayment estimate, the number of years/months you want to pay off the loan is required. The term may be between 1 year and 7 years. Enter your chosen term in the space as indicated.

An optional extra step for business operators is to enter a balloon value in the space provided. This is an optional feature for Hire Purchase and Chattel Mortgage credit facilities.

Outcome The device automatically calculates the estimated monthly repayment for that combination.

Repeat these same basic steps to obtain estimates with different combinations and for different vehicles. When ready to proceed further with your purchase, contact Easy for a quote!

- Simple operation – 3 basic steps to loan repayment estimates.

- Easy use, no special expertise or skill is required.

- No limit – calculate loans for as many vehicles as you want!

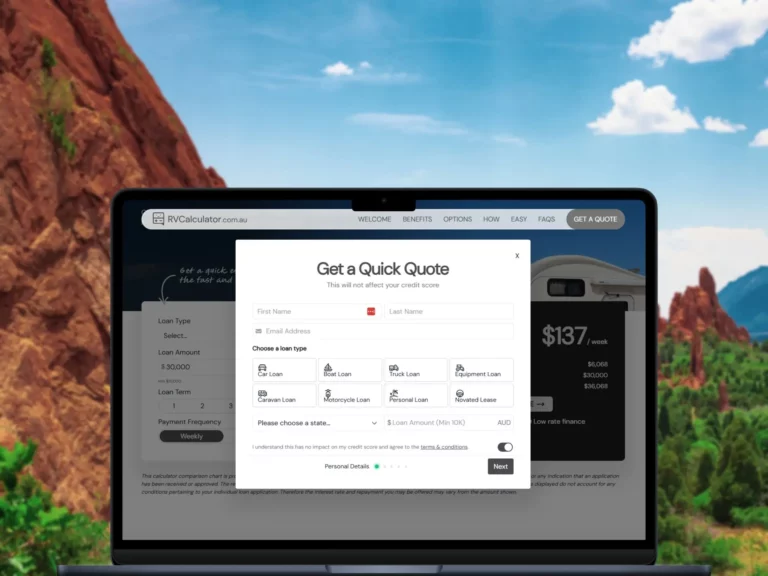

RV Calculator Results Meet Your Expectation? Get Quick Quotes & Easily Apply for Finance with Easy!

When you’re ready to proceed to the next stage, our streamlined processes and simplified finance systems continue with our quotes and application procedures. To request a quote, simply click through for one of our experts to personally handle your requirements.

To apply for a caravan loan, we offer both phone and online options. Provide your details and details of the vehicle to be financed and we’ll advise you of the financials and other documents required for your application. We’ll source you the most competitive loan offer and on acceptance, process your application for prompt settlement. For personal attention and individual service for your caravan finance requirements, connect with Easy Caravan Finance!

The most frequently asked of the questions

What are the differences with loans for caravans and campervans?

The same loan product suits all types of recreational vehicles including campervans and caravans. The interest rate will be based on the credit profile and financials of the loan applicant. The price of the vehicle is considered when lenders assess the applicant’s borrowing limit. Essentially, both caravans and campervans would attract the same loan for an individual applicant.

What is the correct rate of interest to use when working out estimates on a finance calculator?

Online calculators are provided for indication and planning purposes. As a guide for these purposes, users can refer to the rates advertised by the provider of the device or enter another rate they have sourced from another bank or lender.

How is a quote different from the repayment worked out on a finance calculator?

A quote is sourced by a broker or lender and it takes into account lender fees and charges and the individual’s credit profile. A calculator does not allow for these. The calculating device is an estimate only.

If I want upgrade packs on my caravan, can the cost be included in my loan?

The cost of extras and accessories may be included in the same loan as the caravan when purchased at the same time, from the same dealer.

Is the interest rate for caravan loans fixed or variable?

Interest rates on secured caravan loans are typically fixed. Unsecured personal loans which may be used for some used vans, may have a variable or fixed rate.

Is an online finance calculator suitable for loans for used RVs?

Used RVs can attract different interest rates, borrowing limits and terms to new vehicles. Used vehicle buyers can use a calculating device for estimates to be used as a guide only.

What do I enter in the term field on a loan calculator?

Terms for caravan loans can range from 1 to 7 years. Users can enter whatever timeframe they prefer to repay the loan. The final approval is subject to the lender.

Am I required to download an app to be able to use a loan calculator?

Most online finance calculators are provided on broker and lender websites and do not require the downloading of any software or applications. They are used directly from the website.

How do I allow for trading in my current vehicle when using a loan calculator?

If a trade-in is being used to reduce the purchase amount, this value should be deducted from the loan total amount entered.

Does using a loan calculator involve applying for caravan finance?

No. A calculation device is purely a tool for working out estimates and planning preferences with finance. An application involves providing detailed information on financials, employment, etc to a broker or lender.

Let Easy Car Finance simplify the process by taking care of the complicated steps for you